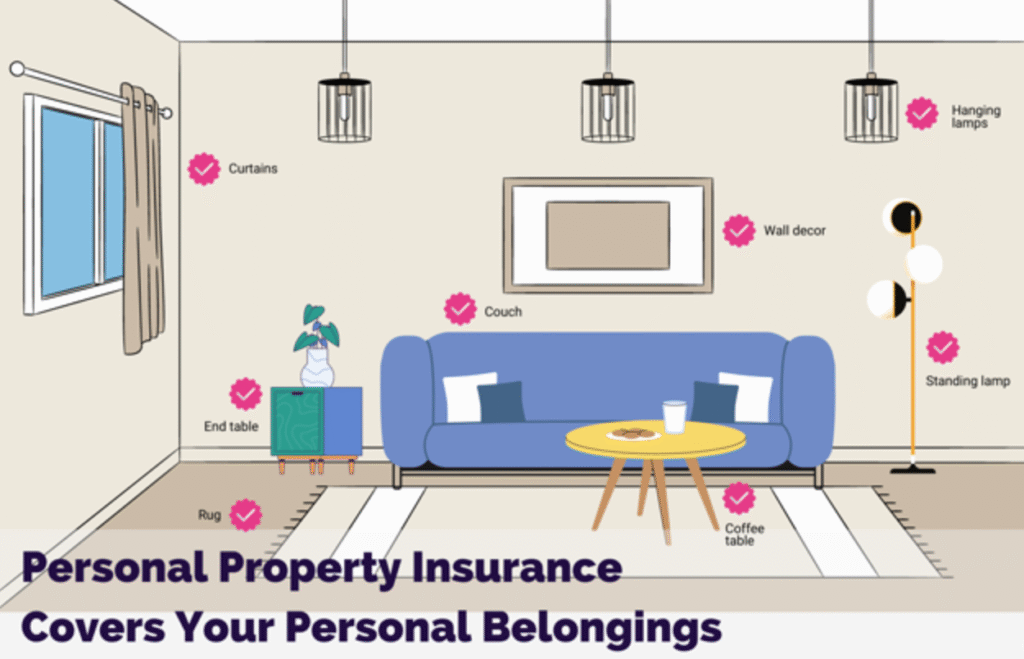

Personal property insurance — also known as Coverage C or contents coverage — is a type of home insurance coverage that insures your belongings against sudden and unexpected perils, such as a house fire or theft. While personal property coverage is legally optional, you may need to buy a homeowners policy that includes it to secure a mortgage loan.

Key Takeaways

- Personal property coverage insures your possessions — like furniture, clothes and electronics — against sudden perils.

- Your mortgage lender will likely require you to buy homeowners insurance, which should automatically include personal property coverage.

- Most personal property insurance policies only cover damage from a limited number of named perils, such as fire and theft.

- Standard homeowners policies cover your personal possessions at their actual cash value (ACV).

- It costs a little over $2,000 per year on average to buy a home insurance policy that includes around $150,000 to $210,000 in personal property coverage.

What Is Personal Property Insurance?

Personal property insurance is a type of homeowners insurance that provides coverage for the items you own, such as furniture, clothing, electronics, kitchen equipment, valuables and more. Home insurance policies typically include off-premises personal property coverage, meaning your belongings will be covered even if they are stolen or damaged outside of your home.

However, your off-premises coverage limit may be restricted to 10% of your overall personal property coverage limit.[1] For example, if you have $120,000 worth of coverage across all of your possessions, only $12,000 may be available for claims involving losses away from your home, such as property that is stolen from your child’s college dorm room.

Is Personal Property Coverage Required?

Personal property coverage is automatically included in a standard homeowners insurance policy, which is not required by law in any state. However, if you need a mortgage to buy a home, your lender may require you to purchase homeowners insurance.

Technically, personal property coverage may still be optional in this scenario because, if you fail to get home insurance for yourself, your lender may buy a force-placed insurance policy on your behalf — which does not cover your personal property. However, it’s recommended that you avoid this since force-placed insurance is typically more expensive than standard home insurance and usually provides less coverage.[2]

Types of Personal Property Coverage

Your personal property insurance policy may provide coverage on an actual cash value (ACV) or replacement cost value (RCV) basis. When you have ACV coverage, your insurer will consider depreciation factors — like age or wear and tear — when determining how much your items are worth and how much to pay you after a covered loss.

As a result, your ACV insurance payout may not fully cover replacing lost items, especially if they are older or have been frequently used.

On the other hand, when you have RCV coverage, your insurer pays whatever it costs to buy comparable new items when your belongings are destroyed, up to your policy limits. Usually, your personal property is automatically insured at its ACV, but you should be able to upgrade to RCV coverage by paying extra.[3]

How Does Personal Property Insurance Work for Homeowners?

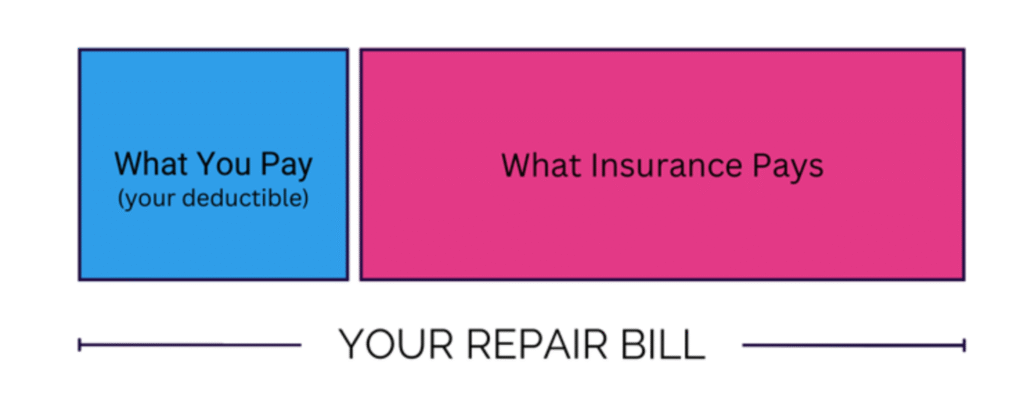

Claims on your personal property insurance are typically subject to a deductible — the amount you are responsible for contributing out of pocket toward each claim you file. For example, if a covered power surge ruins $1,000 worth of electronics and you have a $500 deductible, then your insurer would pay out $500.

Keep in mind that sublimits may apply to certain valuable items, such as jewelry, furs, musical instruments, artwork, collectibles and firearms. For example, some policies will pay out no more than $1,000 toward jewelry theft claims, regardless of how high the overall personal property coverage limit is.[4] As a result, such a policy will not fully reimburse you if your $1,500 wedding ring is stolen.

You may be able to avoid this coverage gap by purchasing a scheduled personal property endorsement. This home insurance add-on allows you to increase sublimits for select valuables so you can insure them at their replacement value. Alternatively, you could purchase a separate valuables insurance policy.

What Does Personal Property Insurance Cover?

The most common type of homeowners insurance policy — HO-3 insurance — provides personal property coverage on a named peril basis.[5] This means your insurance carrier will only cover damage to your personal belongings from the following 16 sources:

| Fire or lightning | Theft |

| Windstorm or hail | Volcanic eruptions |

| Explosion | Falling objects |

| Riot or civil commotion | Weight of ice, sleet or snow |

| Damage by aircraft | Water/steam discharge from home systems and appliances |

| Damage by vehicles | Sudden/accidental tearing, cracking, burning or bulging of home systems |

| Smoke | Freezing of home systems |

| Vandalism or malicious mischief | Sudden/accidental power surges |

Nevertheless, if you’re willing to pay a higher premium, you may be able to upgrade to open peril coverage. This means your insurance company will cover any source of damage to your property as long as it isn’t explicitly named as an exclusion in your policy.

What Isn’t Covered?

Even if your policy includes open peril coverage, your personal property insurance likely won’t cover the following sources of damage:

| Flooding | Earthquakes and other ground movements |

| Infestations | Mold |

| Government actions | War or nuclear hazards |

| Intentional damage | Wear and tear |

You should note that you may be able to secure coverage for some of these perils by purchasing additional policies, such as flood insurance or earthquake insurance. Conversely, some types of damage, like gradual and predictable losses, are never covered by insurance.

How Much Personal Property Coverage Do I Need?

As a general rule, you should buy enough personal property coverage to pay to replace your most important possessions in the event of a total loss. To determine how much coverage you need, consider making a home inventory that records relevant information about these items — such as when you purchased them and how much you paid.

Your personal property coverage limit is often automatically set between 50% and 70% of the amount of coverage you have for the structure of your home.[1] Nevertheless, you will likely have the option to increase your coverage limit if you have a significant number of expensive items you want to insure against covered perils.

How Much Does Personal Property Insurance Cost?

The cost of personal property coverage is bundled into the overall cost of homeowners insurance, which averages $2,242 per year as of March 2025. This average rate applies to sample policies with $300,000 worth of dwelling coverage, so paying that premium may get you between $150,000 and $210,000 worth of personal property coverage.[6]

How To File a Personal Property Claim

You can take the following steps to file a claim on your personal property insurance after a covered loss:

- If your claim is related to a crime, like vandalism or theft, call 911 so the responding officers can complete a police report.

- Schedule an appointment with an adjuster from your home insurance company.

- Use your phone to take photos or videos of your damaged belongings.

- Make emergency repairs to prevent further damage to your personal property, if needed.

- Notify your mortgage lender about the property damage and insurance claim.

- Provide evidence during the insurance adjuster’s visit, including photos or videos, police reports and home inventories.

- Keep any documents related to your claim, such as receipts for replacement items.

- Monitor the status of your claim, and complete any paperwork or address issues as needed.

- Use your insurance settlement to repair or replace your belongings — or dispute the payout with the assistance of a lawyer or public adjuster if you believe your insurer owes you more money.

How To Get Personal Property Insurance for My Belongings

Shopping for personal property insurance requires comparing quotes from three to five unique insurance companies to figure out which carrier can offer you the best deal on the coverage you need. However, it can undoubtedly take a while to individually contact several insurers to provide them with your information and ask for quotes.

Fortunately, we make comparison shopping easy. Simply answer a few questions online, and we’ll connect you with an expert insurance agent who can help you find the right policy for your situation. Begin your insurance questionnaire and start comparing home insurance rates for free today!

FAQs

DetroitAuto48204

Does personal property insurance cover jewelry?

Yes, personal property insurance covers jewelry. However, your valuable items may be subject to sublimits, so you may need additional coverage to comprehensively protect your jewelry.

What are the two types of personal property coverage?

The two types of personal property insurance are actual cash value (ACV) coverage and replacement cost value (RCV) coverage.

Are appliances covered under personal property insurance?

Yes, personal property insurance generally covers appliances, although built-in appliances may instead be covered by your dwelling insurance.[7]

Does standard home insurance cover personal property?

Yes, personal property coverage is automatically included in a standard home insurance policy.